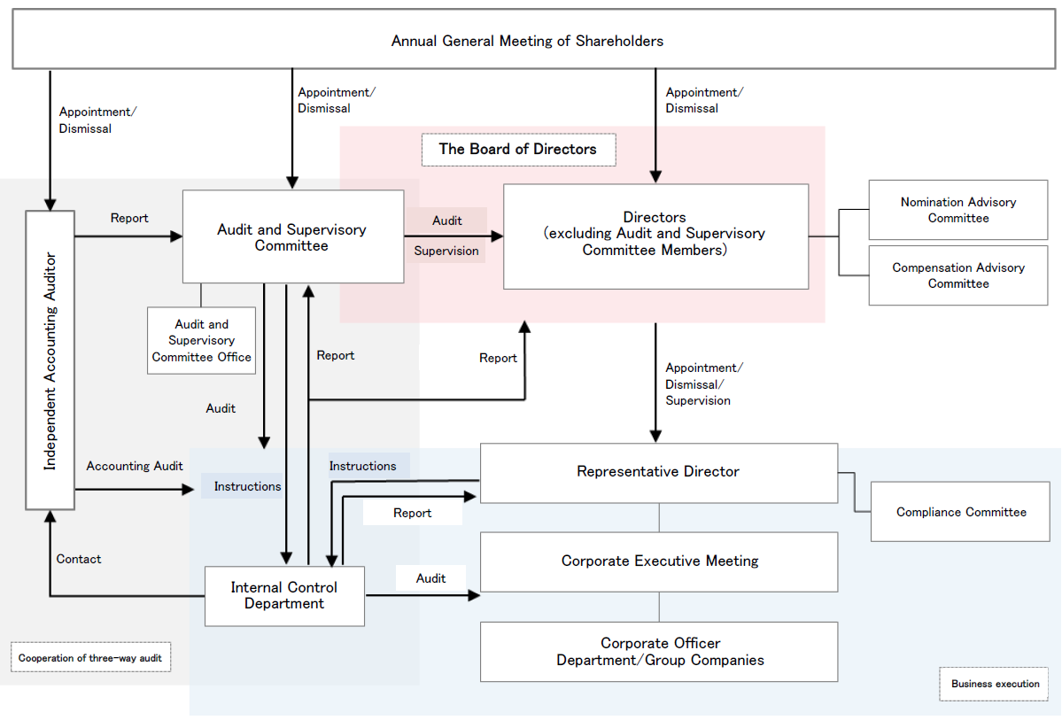

Corporate Governance System

The Company has adopted the structure of a company with an Audit and Supervisory Committee to strengthen the supervisory function of the Board of Directors over the Representative Director amid the globalization and expansion of its business. This structure enables the Company to clearly distinguish between matters delegated to the executive side and those resolved by the Board of Directors, thereby establishing a framework that facilitates delegation of authority to ensure swift decision-making and promote in-depth discussions on company-wide mid- to long-term strategies with a focus on balancing the interests of all stakeholders. Additionally, the Company has enhanced the development and operation of its internal control systems, allowing the Audit and Supervisory Committee to more effectively oversee the overall decision-making process of the executive side by leveraging its authority and working with the internal audit department.

Board policies and procedures in the appointment of the senior management and the nomination of director candidates

The guidelines and procedures of the Board in the nomination of candidates for Directors are as follows :

<Guidelines>

In order to allow us to enhance business oversight by directors, improve management transparency, and ensure impartiality in management, the Company will nominate the candidates for directors in accordance with the following views and guidelines from the standpoint of diversity, in addition to the Company’s financial results, compliance status and other factors.

(1) Independent directors shall account for half or greater than half of the board.

(2) Various aspects including management experience, specialized knowledge in areas such as law and finance, medical and pharmaceutical viewpoints, and knowledge and experience in international business, as well as the overall balance of the Board of Directors, shall be considered.

(3) Ensuring diversity in terms of gender, age, nationality and expertise shall be considered.

In addition, when selecting Directors, the Company will nominate as candidates for Directors those who meet the criteria for appointment and reappointment separately established by the Board of Directors, in consideration of the above perspectives.

In selecting candidates for Directors who are Audit and Supervisory Committee Members, the Company’s policy is to nominate individuals who can express opinions in a fair and objective manner, contribute to enhancing the soundness and transparency of management, and possess the appropriate experience and capabilities required to fulfill their roles and responsibilities. These responsibilities include auditing the execution of duties by Directors (business audits), and auditing the appropriateness of accounting audits conducted by the Accounting Auditor and by the Corporate Auditors of group companies (accounting audits). Candidates should also have knowledge of legal affairs or appropriate insight into finance and accounting.

In the event of wrongdoing or a serious legal violation in the execution of duties by a director that causes a significant loss to the Group, or if an event occurs that disrupts the Group’s business operations, and after sufficient investigation, the Company will proceed with the dismissal procedures of said director. The Representative Director and Executive Directors shall be removed from office by resolution of the Board of Directors.

<Procedures>

The Nomination Advisory Committee, which is comprised of a majority of independent outside directors and is chaired by one of them, conducts fair, transparent, and rigorous deliberations, and the candidates are determined by the Board of Directors based on the Committee’s recommendations. Approval from the Audit and Supervisory Committee shall be required in the case of directors who are members of the Committee.

Board of Directors

The Company has established a governance structure comprising six Directors who are not Audit and Supervisory Committee Members and five Directors who are Audit and Supervisory Committee Members. Among the 11 Directors, three are women and one is a non-Japanese national, ensuring diversity in the Board. With the appointment of seven Outside Directors, who constitute the majority of the Board, the Company maintains a structure that enables fair and efficient management. All seven Outside Directors serve as independent directors, recognizing the Company’s corporate responsibilities and contributing to highly transparent management. The Chairperson of the Board of Directors is Keiichi Ando, and the Chairperson of the Audit and Supervisory Committee is Junko Goto. Prior to the transition to a company with an Audit and Supervisory Committee, in FY2024, the Board of Directors consisted of six members, two Internal Directors and four independent outside directors, with Director Keiichi Ando serving as Chairperson. In principle, the Board of Directors met once a month, convening 13 times in total. Specifically, the Board of Directors made decisions on important matters affecting management, such as corporate governance, enterprise risk management, and the conclusion of material contracts, while also receiving reports on compliance activities and progress in business execution by each department, thereby supervising the execution of duties. The attendance rate of Directors and Corporate Auditors was 100% for all Board meetings.

To ensure management decisions are equitable and to carefully assess the aptitude of candidates for director positions, the impact directors have on business management, and the appropriateness of their duties and compensation, the Board of Directors is advised by the Nomination Advisory Committee (five Outside Directors and two Inside Directors) and the Compensation Advisory Committee (five Outside Directors and two Inside Directors), which are chaired by Outside Directors.

Audit Framework

To ensure the legality and appropriateness of duties carried out by Directors and each organizational unit, the Audit and Supervisory Committee and the Internal Control Department, which is responsible for internal audits, conduct audits of the status of business execution as appropriate, while exchanging opinions with the Representative Director and reporting to the Board of Directors, thereby establishing a system to take necessary actions. The Audit and Supervisory Committee consists of two Inside Directors who serve as full-time members and three Outside Directors who serve as members, and is chaired by Director Junko Goto. The Audit and Supervisory Committee conducts business and accounting audits in accordance with the “Standards for Audit and Supervisory Committee Audits” to verify the legality and appropriateness of the duties carried out by directors and persons responsible for business execution. It also receives reports from the Accounting Auditor on the content of accounting audits and takes actions such as exchanging opinions. In addition, Directors who are Audit and Supervisory Committee Members attend important meetings such as the Corporate Executive Meeting and express necessary opinions. Together with the newly established Audit and Supervisory Committee Office, efforts are being made to enhance deliberations at the Audit and Supervisory Committee. Furthermore, the Committee also receives regular reports from the Internal Control Department on the contents of internal audits and exchanges opinions, while issuing instructions to the department as appropriate, thereby ensuring coordination among the Audit and Supervisory Committee, the Accounting Auditor, and the Internal Control Department.

In addition, the Company has concluded an audit contract with Ernst & Young ShinNihon LLC as its Accounting Auditor. The certified public accountants who served as the designated engagement partners for the Company’s audit are Koichiro Kitaike and Naoki Nakazawa.

Business Execution Framework

The Company has introduced an executive officer system to enable rapid and flexible business operations, in order to respond promptly to changes in the operating environment. As a decision-making body for business execution, the Company has established the Corporate Executive Meeting, which is composed of Internal Directors and key executives responsible for business execution and is, in principle, held weekly. At the Corporate Executive Meeting, thorough deliberations are conducted on a wide range of matters, from issues related to business execution to important matters.

The business execution framework consists of ten divisions: the Drug Discovery Research Division, the Pharmaceutical Technology Research Division, and the Drug Development Division, which engage in R&D; the Pharmaceutical Commercial Division, which communicates pharmaceutical information; the Healthcare Strategy Division, which collects and analyzes healthcare-related information to maximize product and corporate value; the Vaccine Business Division, which establishes and promotes the vaccine business as a new business foundation; the Corporate Strategy Division, which formulates company-wide strategies for optimal allocation and utilization of managerial resources; the Sustainability Management Division, which strengthens engagement with stakeholders; the DX Promotion Division, which aims to create healthcare solutions by building a data utilization infrastructure using IT and digital technologies; and the Corporate Quality Assurance Division, which strengthens the compliance framework to provide trusted-quality products and services. These divisions are organized under a structure supervised by four major value chains. In executing business operations, thorough deliberations are held at the Corporate Executive Meeting, and matters that have a significant impact on management are decided by the Board of Directors.

Analysis and self-evaluation of the effectiveness of the Board of Directors

The Board of Directors analyzed and evaluated its effectiveness in FY2024 prior to the transition to a company with an Audit and Supervisory Committee, by conducting questionnaires and interviews of individual directors and corporate auditors, with a focus on (1) Framework, (3) Roles and Responsibilities, and (6) Operation in “6. Directors and the Board” in the “Basic Views and Guidelines on Corporate Governance” set by the Company.

The following is a summary of the results:

1. Organizational Structure

We assess that the Board of Directors has currently secured the necessary framework from the standpoint of various attributes, including expertise and experience, and diversity, such as by appointing foreign and female director candidates. However, future challenges include responding to globalization, appointing successor candidates, and expanding the talent pool for developing and selecting future director candidates from the standpoint of diversity, including expertise and succession, in light of the expansion and changes in the Company’s business.

2. Roles and Responsibilities

We have made significant progress toward succession by reporting and supervising the status of senior management development, including conducting a performance review of the President and preparing and utilizing succession plans for Executive Officers. In addition, we continued to monitor the development status by providing reports at opinion exchange meetings among outside directors/corporate auditors and the President, and by holding roundtable meetings between Executive Officers and Corporate Officers (senior management candidates) and outside directors. Furthermore, matters related to compliance and risk management were regularly reported to the Board of Directors, and active discussions were held. We proposed and reported matters related to sustainability and human capital on multiple occasions, and these matters were discussed and approved at Board of Directors meetings.

As a future challenge, the Board of Directors identified the need to examine mid- to long-term management strategies, the direction of authority delegation, and the distinction between matters to be resolved and reported at Board meetings, in light of the change in governance structure.

The Board of Directors will continue to explore ways to improve its roles and responsibilities.

3. Operation

In order to further stimulate discussions at Board of Directors meetings, the Board of Directors has continued to provide periodic pre-briefings on the agendas of Board of Directors meetings and has reported on the progress of matters resolved at the meetings as appropriate. Off-site venues other than Board of Directors meetings were utilized to deepen discussions and enhance information sharing.

As a future challenge, the Board of Directors identified the need to consider opportunities to provide information to Directors other than Audit and Supervisory Committee Members in light of the change in organizational design. Opinions were expressed on how to further enhance discussions, including reviewing the methods of explanation at Board meetings, providing materials earlier, and utilizing opportunities outside the Board meetings.

The Board of Directors will continue to explore ways to improve its operation.

Based on the above, we assess that the Company’s Board of Directors has been operated appropriately and its effectiveness has been secured. We will use the results of this self-evaluation as a basis for making continuous improvements to make the Board of Directors even more effective.

For details on corporate governance, please refer to the “Corporate Governance Report”.