OSAKA, Japan, May 11, 2022 - Shionogi & Co., Ltd. (Head Office: Osaka, Japan; President and CEO: Isao Teshirogi, Ph.D.; hereafter “Shionogi” or “Company”) hereby announces that at a meeting held today, the Board of Directors resolved to establish the Shionogi Infectious Disease Research Promotion Foundation, a General Incorporated Foundation (the “New Foundation”), to dispose of treasury stock (3 million shares) by way of third-party allotment in order to continuously and stably support the activities of the New Foundation, to acquire treasury stock (up to 7.2 million shares or 50 billion yen) pursuant to the provisions of Article 156 of the Companies Act, applied by replacing terms pursuant to the provisions of Article 165, paragraph 3 of the same Act, and to cancel treasury stock (4.2 million shares) pursuant to the provisions of Article 178 of the same Act. The disposition of treasury stock is subject to the approval of shareholders at the 157th Ordinary General Meeting of Shareholders to be held on June 23, 2022, and the acquisition and cancellation of treasury stock is subject to the approval of the disposition of treasury stock at the said shareholders meeting.

COVID-19 that emerged at the end of 2019 has continued to have a tremendous impact on people’s lives, but there are still more threats to humankind in the world, such as three major infectious diseases (AIDS, tuberculosis and malaria) and tropical diseases. Many unmet medical needs still remain for infectious diseases, such as the emergence and spread of antimicrobial resistance (AMR) and virus variants as well as above threats.

Based on the Company Policy “Shionogi strives constantly to supply the best possible medicine to protect the health and wellbeing of the patients we serve,” Shionogi aims to develop into a company indispensable to society by meeting medical needs and providing solutions to social issues through business activities and to share the values of these efforts with stakeholders. Shionogi is committed to “Protect people worldwide from the threat of infectious diseases” as our key focus. We are not limiting ourselves to the research and development of therapeutic medications, but are also focused on the total care of infectious disease, through awareness-building, detection and forecast, prevention, diagnosis, and treating exacerbations, as well as the infection itself. As a result of considering the current situation in which society has recognized anew the importance of persistent research activities in infectious disease area and the need to prepare for possible future pandemics, Shionogi has concluded that in addition to promoting in-house research and development and strengthening collaboration with industry groups and partners, it is necessary to create a new framework to widely support research on infectious diseases, and it has decided to establish a new foundation.

With the aim of supporting and promoting research on infectious diseases, which pose a threat to humankind, and thereby contributing to the promotion of science and the human health and welfare, the New Foundation will play a role in accelerating efforts to resolve these social issues. Shionogi believes that these activities will contribute to the realization of the Shionogi Group’s philosophy and lead to the sustainable growth of the Company and enhancement of corporate value over the medium to long term. Shionogi will continue to actively engage in various issues and activities with the aim of overcoming infectious diseases.

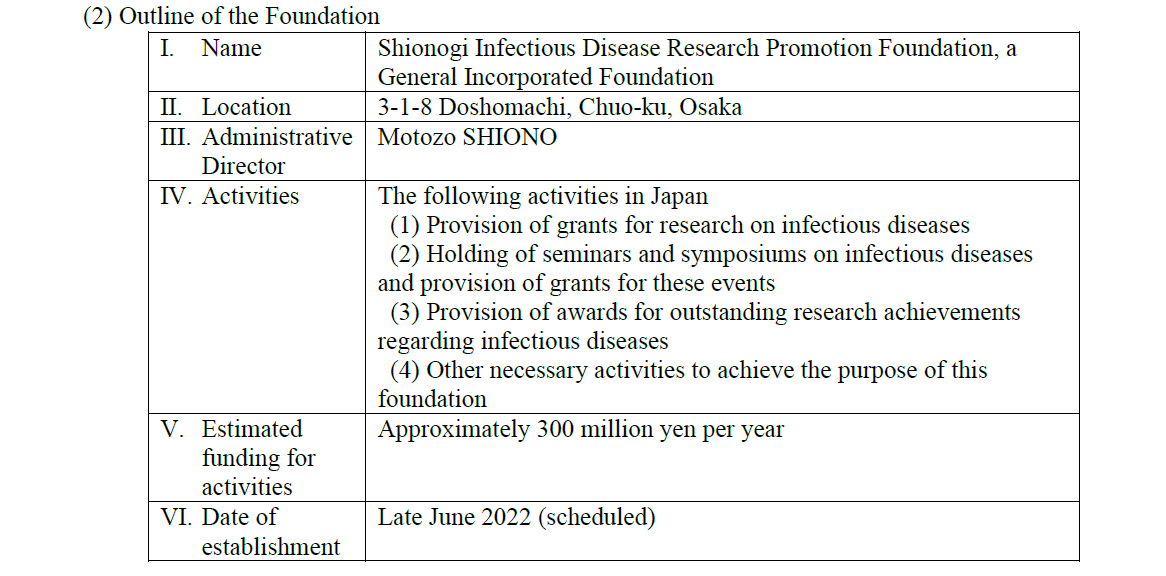

1. Establishment of the New Foundation

(1) Purpose of establishment

By supporting and promoting research on infectious diseases, which pose a threat to humankind, we aim to contribute to the promotion of science and the improvement of the health and welfare of humankind.

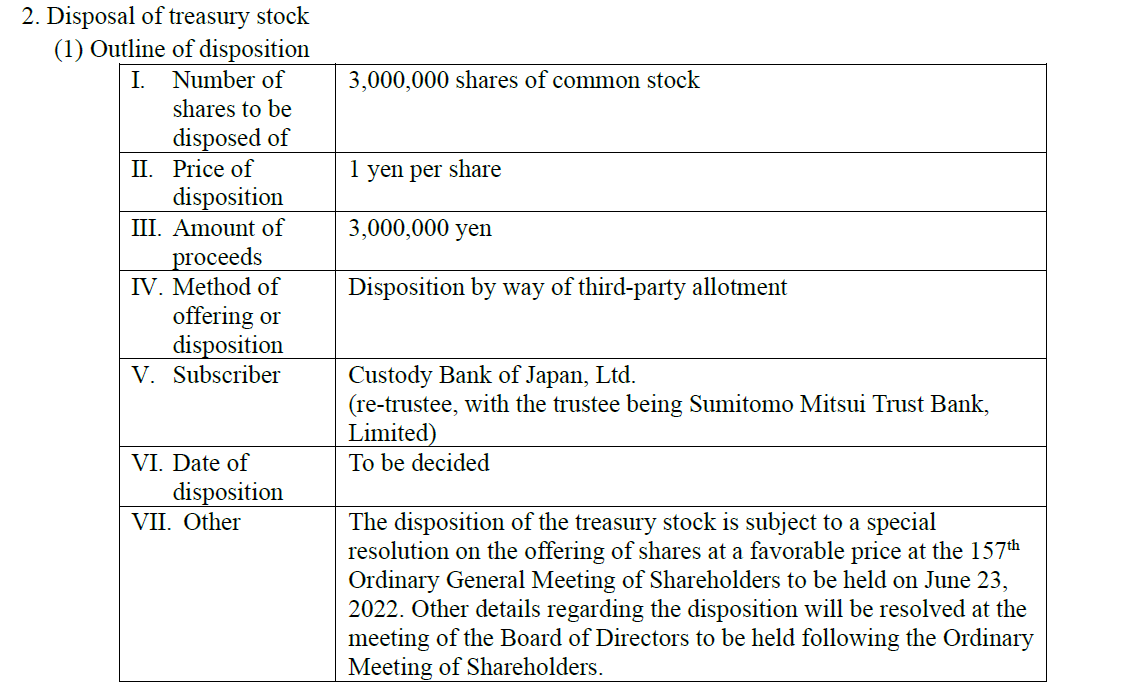

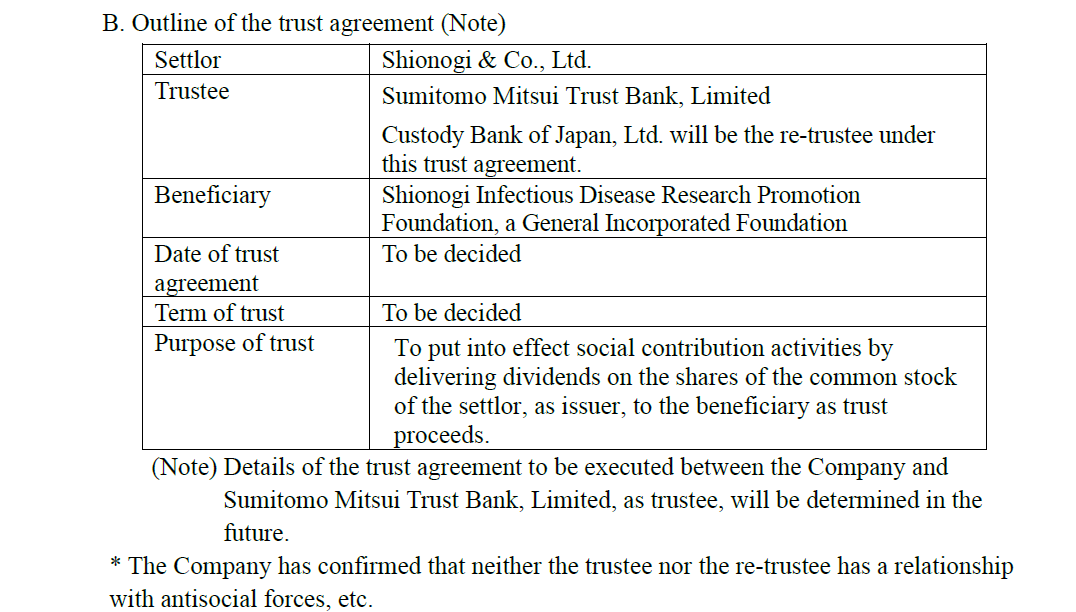

(2) Purpose and reason for disposition

In order for the New Foundation to continuously and stably implement social contribution activities in line with its objective, the Company will establish a third-party benefit trust (the “Trust”) with Sumitomo Mitsui Trust Bank, Limited as trustee, Custody Bank of Japan, Ltd. as re-trustee, and the New Foundation as beneficiary. The Trust will subscribe to purchase shares of the Company’s stock. The Trust will pay trust proceeds earned from dividends, etc. on the Company’s stock to the New Foundation, and the New Foundation will use trust proceeds to fund its activities.

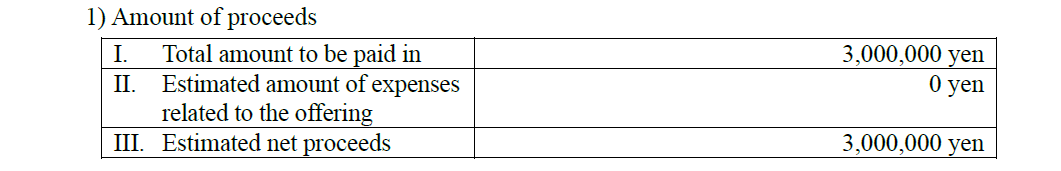

(3) Amount of proceeds, use of proceeds and expected timing of spending

2) Specific use of proceeds

The above estimated net proceeds are scheduled to be applied towards the costs incurred for preparation for the establishment of the New Foundation.

(4) Reasonableness of use of proceeds

The proceeds are scheduled to be applied to expenses, such as attorneys’ fees, incurred in connection with considering the establishment of the New Foundation. Each of those expenses is necessary for the establishment of the New Foundation, and in light of the New Foundation’s activities, the Company believes that the said use of proceeds is reasonable.

(5) Reasonableness of the terms and conditions of disposition, etc.

1) Basis and details for calculating the amount to be paid in

The Company believes that the New Foundation, with the mission of supporting and encouraging research on infectious diseases which pose a threat to humankind and thereby contributing to the health and welfare of humankind, will play a role in accelerating these efforts to resolve social issues. The disposition of treasury stock is for the purpose of funding the social contribution activities of the New Foundation, and the amount of proceeds will be allocated to the costs related to preparation for the establishment of the New Foundation as described in (3) 2) above. Therefore, the Company believes that the price of disposition of 1 yen per share is reasonable. In addition, since the disposition of treasury stock qualifies as an offering at a favorable price to the New Foundation, the disposition is subject to a special resolution at the 157th Ordinary General Meeting of Shareholders to be held on June 23, 2022.

2) Basis for determination that the number of shares to be disposed of and the level of share dilution are reasonable

As the New Foundation will continuously and stably implement its activities, such as the provision of aid to organizations whose activities are in line with its objective, the Company believes that the number of shares to be disposed of is of a reasonable size for funding the activities of the New Foundation. Moreover, as it is not currently expected, under the structure of the scheme, that the treasury stock would be sold into the market after the disposition, and as the impact on the secondary market triggered by the disposition of treasury stock will be small, the Company believes that the number of shares to be disposed of is at a reasonable level.

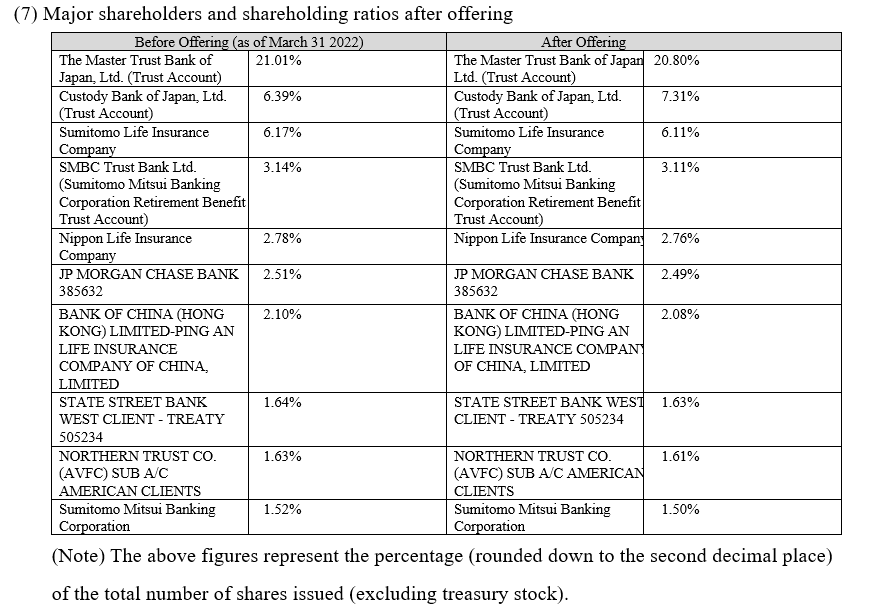

As the extent of dilution of the shares of the Company’s stock triggered by the disposition of treasury stock is small, representing 0.96% (rounded to the second decimal place; 1.00% against the aggregate number of voting rights of 3,010,818 as of March 31, 2022) of the total number of issued shares, the Company believes that the impact on the stock market triggered by the disposition of treasury stock will be small. In addition, since the Company plans to implement measures to deal with the dilution of its shares, namely acquisition of treasury stock at a number that exceeds the number of treasury stock to be disposed of (subject to the approval of the disposition of treasury stock at the 157th Ordinary General Meeting of Shareholders to be held on June 23, 2022) as described under “3. Acquisition of treasury stock” below, the Company believes that the extent of dilution of shares is reasonable.

(6) Reason for selection of subscriber, etc.

1) A. Outline of the subscriber

Custody Bank of Japan, Ltd., as re-trustee of the Trust, will accept the allotment of shares as trust assets of the Trust.

2) Reason for selecting the subscriber

In order to achieve the purposes described under “(2). Purpose and reason for disposition” above, the Company determined that Sumitomo Mitsui Trust Bank, Limited was most suitable due to its excellent track record and experience in trust business, and the Company selected it as trustee of the Trust and Custody Bank of Japan, Ltd. the re-trustee, as subscriber.

3) Subscriber’s policy on holding shares

Pursuant to the trust agreement to be executed in the future, the Trust will hold the shares to be disposed of, except where it is determined that achieving the purpose of the Trust, namely to maintain the New Foundation as beneficiary, is difficult. In the event that the Trust is terminated, the trust property will be delivered to the beneficiary of the Trust, as is.

Furthermore, the voting rights of the shares held by the Trust upon disposition of the treasury stock shall not be exercised through the term of trust.

The Company has obtained informal consent from Sumitomo Mitsui Trust Bank, Limited, which re-entrusts trust administration to Custody Bank of Japan, Ltd., the subscriber, (i) that if all or part of the disposed shares are transferred within two years from the date of payment, the names and addresses of the transferees, number of shares transferred, date of transfer, transfer price, reason for transfer, method of transfer, etc. will be immediately reported in writing to the Company, (ii) that the Company will report the details of such report to the Tokyo Stock Exchange, and (iii) that the details of such report will be made publicly available.

4) Confirmed facts regarding existence of assets necessary for payment by the subscriber

Custody Bank of Japan, Ltd., as subscriber, will make the payment in cash, which will be the trust property of the Trust to be established by the Company.

(8) Future prospects

The Company expects that the impact of the third-party allotment on its future business results will be immaterial. To the extent any disclosable matters arise in the future, it plans to promptly make the appropriate disclosure.

(9) Matters relating to procedures based on the corporate code of conduct

Because (i) the dilution ratio is less than 25% and (ii) there is no change in controlling shareholders, there is no need to obtain an opinion from an independent third party or to follow the procedures for confirming the intent of shareholders pursuant to Article 432 of the Securities Listing Regulations established by the Tokyo Stock Exchange.

3) Status of equity finance for the last three years

Not applicable.

Note: The description of the disposition of treasury stock in 2. above was not prepared for the purpose of soliciting an offer to purchase or subscribe for shares of the Company’s common stock.

3. Acquisition of treasury stock

(1) Reason for acquiring treasury stock

The acquisition will be made to strengthen shareholder returns that will lead to further improvement of corporate value, improve capital efficiency, and implement agile capital policy in view of the management environment. In addition, it aims to deal with the diluting of stock value due to disposition of treasury stock described in 2. above.

(2) Details of matters relating to acquisition

1) Kind of stock to be acquired: Common stock of the Company

2) Total number of shares to be acquired: 7,200,000 shares (maximum)

(Represents 2.39% of the total number of shares issued (excluding treasury stock))

(Rounded to the second decimal place)

3) Total purchase price for acquisition of shares: 50 billion yen (maximum)

4) Period of acquisition: From the end of the 157th Ordinary General Meeting of Shareholders to be held on June 23, 2022 to December 31, 2022

5) Method of acquisition: Market purchase on the Tokyo Stock Exchange

6) Other: The acquisition of treasury stock is subject to the approval of the disposition of treasury stock described in 2. above at the shareholders meeting.

(Reference) Number of treasury stock as of March 31, 2022

Total number of shares issued (excluding treasury stock): 301,482,780 shares

Number of treasury shares: 10,103,385 shares

4. Cancellation of treasury stock

(1) Details of matters relating to cancellation

1) Kind of stock to be cancelled: Common stock of the Company

2) Number of shares to be cancelled: 4,200,000 shares

3) Scheduled date of cancellation: February 10, 2023 (scheduled)

4) Other: The cancellation of treasury stock is subject to the approval of the disposition of treasury stock described in 2. above at the shareholders meeting.

###

For Further Information, Contact:

SHIONOGI Website Inquiry Form : https://www.shionogi.com/global/en/contact.html