SHIONOGI Group’s Climate Change Strategies

Climate Change Countermeasures as Part of Management Strategy

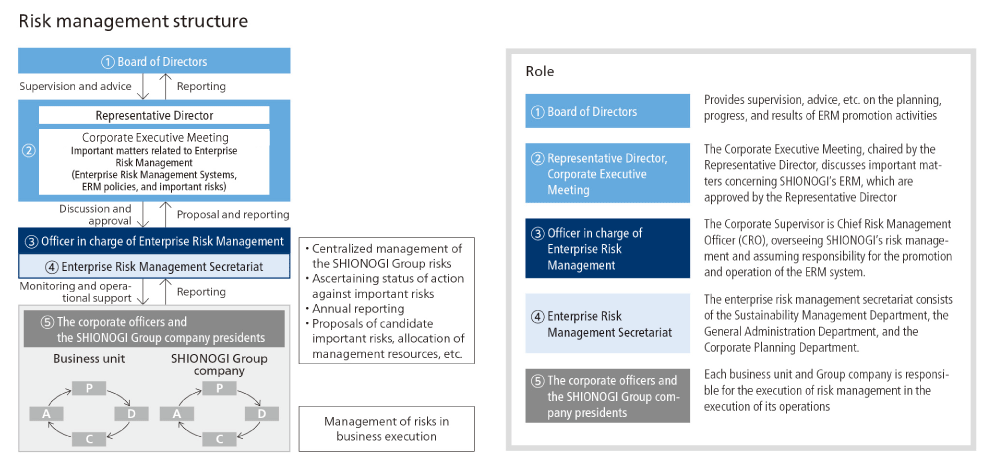

SHIONOGI’s Governance Structure and Risk Management

(Governance: Recommended disclosures a and b)

(Risk management: Recommended disclosure c)

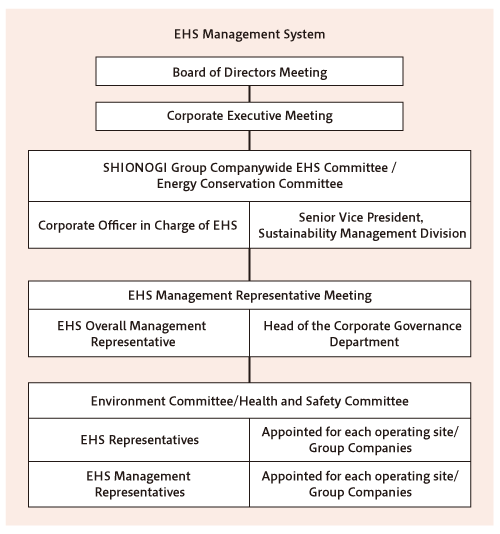

*2 SHIONOGI Group Companywide EHS Committee: An organization that deliberates on and approves important EHS matters across the whole group, including environmental policies, medium- and long-term targets, performance reviews, identification of environmental issues, and environmental risk assessment.

*3 Energy Conservation Committee: An organization that is placed under the SHIONOGI Group Companywide EHS Committee and deliberates on matters concerning climate change and energy conservation

Consideration of SHIONOGI’s Climate Change Strategies

Process to identify and assess risks and opportunities and to develop countermeasures

Details on how to proceed with scenario analysis

・1.5°C scenario: The average temperature increase is kept below 1.5°C in 2100 compared to the pre-industrial level.

- Reference climate scenarios: IEA*4-NZE, IPCC*5-1.5, and IPCC AR6 SSP*61-1.9, and the like

- More rigorous measures (including a carbon tax and environmental regulations) are introduced, and society as a whole proactively works on measures to tackle climate change.

・4°C scenario: The average temperature rises by 4°C in 2100 compared to the pre-industrial level.

- Reference climate scenarios: IPCC AR6 SSP3-7.0/SSP5-8.5 and the like

- Stricter measures (including a carbon tax and environmental regulations) are not introduced, resulting in more severe and frequent natural disasters (a world of “Take it as it comes”)

*5 IPCC: Intergovernmental Panel on Climate Change

*6 SSP: Shared Socioeconomic Pathway

External environment surrounding SHIONOGI |

1.5°C scenario | 4°C scenario |

|---|---|---|

| Policies and regulations | Stronger policies to achieve carbon neutrality by 2050 (such as introducing a carbon tax, increasing the renewable energy ratio, and stepping up energy conservation efforts) | More powerful policies to deal with catastrophic disasters (regulations, subsidies, and other policy support) |

| Investment/lending institutions | Requests more demanding than policies toward carbon neutrality | Although there is pressure to respond to the deteriorating natural environment as climate change advances, the pressure is not strong enough to affect investment and lending decisions |

| Society | Changes in values (consumption propensity) brought about by a decarbonized society | The same situation as the current one |

| Natural environment | Gradual changes in the climate | More severe and frequent natural disasters and changes in precipitation patterns |

Targets of scenario analysis

| Classification | Main risks and opportunities | Details of the anticipated risks and opportunities | Single-year financial impact for FY2030*7 | |||

|---|---|---|---|---|---|---|

| 1.5°C scenario | 4°C scenario | Remarks | ||||

| Transition risks | Policy | Introduction of carbon pricing | New regulations put in place on manufacturing, procurement, and other business activities, such as introducing and expanding carbon taxes, emissions regulations, and emissions trading systems | Medium | Small | Approximately 6.1 billion yen*8 in the anticipated worst case scenario for Scopes 1-3 of SHIONOGI (in the 1.5°C scenario) |

| Tougher energy-saving regulations | Energy-saving regulations for manufacturing facilities becoming tougher than the annual average reduction of 1% or more in energy consumption per unit required by the current Act on Rationalization of Energy Use and Shift to Non-fossil Energy, resulting in additional capital investment | Small | Small | |||

| Physical risks | Acute | Impact on raw material procurement due to locally abnormal weather and rising temperatures | Procurement of biological raw materials becoming difficult because of the adverse effects of rising temperatures on growth and yield, quality, price, and other factors | Large | Large | The identified risk is based on the assumption that lysate reagents used in quality testing are unavailable |

| Damage to supply chain facilities due to intensifying storm and flood damage | Disruption or suspension of supply chain operations caused by locally abnormal weather (such as typhoons and sudden downpours) and associated disasters (equipment damage, flooding, power outages, and other damage) | Small | Small | |||

| Chronic | Rising sea levels | Plants or other operating sites becoming inoperable due to rising sea levels | Large | Large | The identified risk is based on the worst case scenario in which an operating site, such as a plant, must be relocated | |

| Opportunities | Market | Cultivation of new markets and regions through research and development of new medicinal products | Application of the technologies and expertise that SHIONOGI has cultivated to the treatment of other diseases | Small | Small | The identified opportunity is based on the assumption that drugs to treat NTDs (Neglected Tropical Diseases) will be developed and launched |

| Switching to ecofriendly low-carbon containers and packaging | Cost reduction resulting from replacement with environmentally friendly packaging materials | Small | Small | |||

*8 The estimated figure is based on a carbon tax internally calculated as 20,575 yen/t-CO2 with reference to the IPCC Special Report on Global Warming of 1.5°C.

Assessing and identifying risks and opportunities

Table 2 above shows the results of our assessment of the risks and opportunities related to climate change using the 1.5°C and 4°C scenarios.

We have identified three items as risks and opportunities stemming from climate change with a relatively large financial impact: 1) introduction of carbon pricing, 2) impact on raw material procurement due to locally abnormal weather and rising temperatures, and 3) rising sea levels. If all the identified risks and opportunities materialize, the financial impact on the core operating profit targeted for 2030, the final fiscal year of SHIONOGI’s medium-term business plan STS2030, was estimated to be limited to around 10%. The STS2030 Revision, which was revised in June 2023, aims to further expand earnings compared to STS2030. Therefore, we judge that the resilience of our business against the climate change scenarios that can be expected in the future is sufficiently secure.

| Identified risk | Classification of risk response policy | Remarks on established policies |

|---|---|---|

| Introduction of carbon pricing | Risk reduction | The possibility of the identified risks becoming reality in the medium term is relatively high, since carbon pricing has already been introduced in some countries and is under consideration in Japan. Therefore, we will mitigate the risks by implementing medium- to long-term activities to reduce our greenhouse gas (GHG) emissions. |

| Impact on raw material procurement due to locally abnormal weather and rising temperatures | Risk retention | We have defined the worst case scenario as the situation where quality testing cannot be conducted because lysate reagents made from the blood components of horseshoe crabs cannot be procured due to their decreasing population caused by climate change, leading to the suspension of shipments of some of our main medicinal products. However, reagent manufacturers are engaged in activities to preserve horseshoe crabs. Also, even if procurement of lysate reagents becomes difficult, alternative reagents using genetically modified proteins exist. Therefore, although the long-term possibility cannot be ruled out, we will retain the risk, judging that the probability of the risk manifesting by 2030 is extremely low at this point. |

| Rising sea levels | Risk retention | There is no doubt about the long-term trend of rising sea levels caused by climate change, and we have set the worst case scenario as the situation where sea level rise may adversely affects operations at some of our key manufacturing sites located in particularly low-lying areas. However, the average sea level rise along the coasts of Japan over the period from 2031 to 2050 is projected to be less than 0.2 m. Therefore, although the long-term possibility cannot be ruled out, we will retain the risk, judging that the probability of the risk manifesting by 2030 is extremely low at this point. |

Carbon tax (carbon pricing)

Metrics and Targets for SHIONOGI’s Climate Change Countermeasures

As mentioned above, we conducted a detailed assessment of the impact of climate change on SHIONOGI’s business using the TCFD framework as a reference. As a result of considering strategies and specific countermeasures, we have set “reduction of GHG (CO2) emissions” as a metric for reducing risks related to climate change. In addition, in response to the Japanese government’s declaration of “Carbon Neutrality by 2050” and the worldwide movement toward reducing GHG (CO2) emissions, we believe that SHIONOGI also needs to aim for carbon neutrality by 2050.

In light of the above, SHIONOGI will promote its activities by setting GHG emissions reduction targets that include SBTs*9 as part of its EHS Action Targets, which are its medium- and long-term targets.

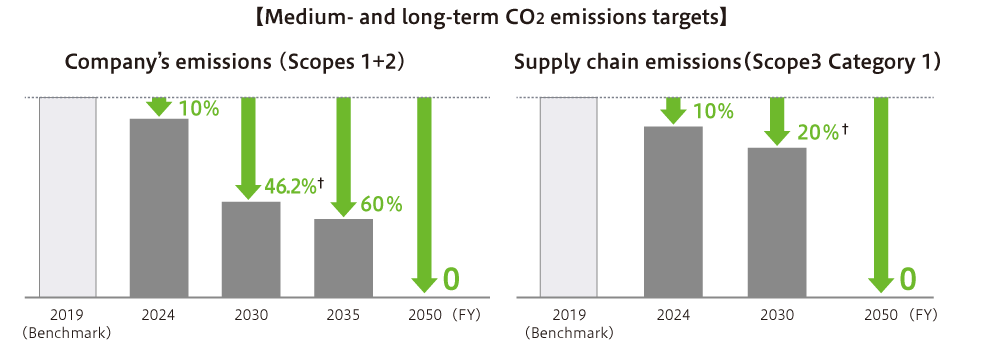

・Metric:

- GHG (CO2) emissions reduction (FY2019 benchmark)

・Targets:

- Reduce GHG emissions (Scopes 1 and 2) by 10% by FY2024.

- Reduce GHG emissions (Scopes 1 and 2) by 46.2% by FY2030.

- Reduce GHG emissions (Scopes 1 and 2) by 60% by FY2035.

- Cut down GHG emissions (Scope 3, Category 1: Purchased products and services) by 10% by FY2024.

- Cut down GHG emissions (Scope 3, Category 1: Purchased products and services) by 20% by FY2030.

- Increase the introduction rate of renewable energy-derived electricity to 90% or more by FY2030.

To improve energy efficiency, we also aim to improve energy intensity by 1% per year and to introduce equipment with high energy consumption efficiency.

Please see the section “Climate Change” for yearly activity progress.

・Other targets regarding climate change countermeasures:

- Reduce energy consumption and improve energy efficiency.

・Promotion of energy conservation efforts to reduce energy intensity by 1% per year

・Promotion of the introduction of highly energy-efficient equipment

- Reduce GHG emissions.

・Promotion of a shift to non-fossil energy sources

・Promotion of the introduction of highly energy-efficient equipment

*9 SBTs (Science Based Targets): CO2 emissions reduction targets based on scientific data